- Wibel: Consumers’ restaurant spending, especially as a percentage of their total food budget, is hitting an all-time high this year. Meanwhile, their demand for fresher foods continues to ratchet up.

To keep pace and maintain margins, operators really have to take a page out of our book as a manufacturer and begin to think in terms of ‘lean manufacturing.’ One aspect of this is what, in our world, we call J.I.T., for “just-in-time” delivery of components to keep production as efficient as possible.

Well, moving from precut and packaged ingredients to fresh, while it can be a big labor investment, it doesn’t have to be. Considering fresh produce is actually designed by nature to maintain a longer shelf life over precut, with the right prep equipment, fresh can really become a J.I.T. model of efficiency.

- Carcione: Fresh will force operators to examine every detail of cost control in ways many of them haven’t before.

To Michelle’s point, labor will be a major factor, as it always has been, with respect to more efficient prep and cooking. But, now, we’re talking about details in kitchen layout. Literally, the steps employees are taking. We’re talking about cleanup and maintenance procedures.

But, also, back on the equipment side, operators will have to find ways to more tightly control food costs by preventing waste that may occur through over-portioning or as a result of discarding foods that weren’t held at correct temperatures, whether hot or cold. And, because of this movement toward fresh, inspectors are getting even more critical of food holding.

2. Off-Premises Dining Becoming a Do-or-Die Scenario

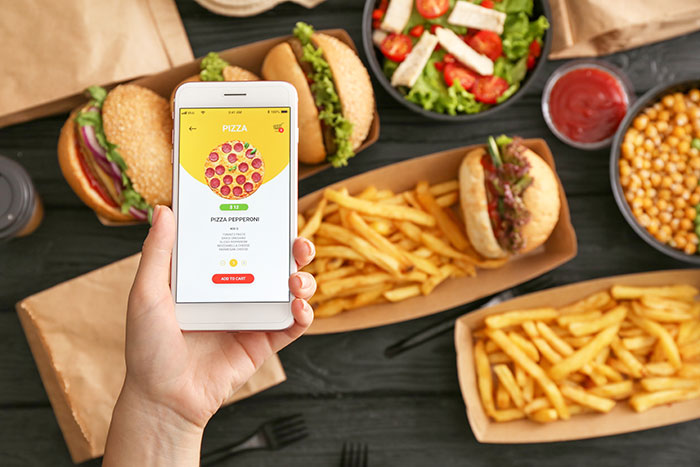

- Carcione: Takeout and delivery is no longer an added revenue-stream option. It’s got to be part of your business model. I mean, now you have ghost kitchens.

So, operations need smaller and more versatile equipment that can keep kitchens lean and nimble. Plus, because speed of service is even more crucial in an off-premises model, equipment purchases should also emphasize performance reliability or backup planning or both to stay immune to any kind of equipment downtime that can dent the brand or maybe even be business fatal.

Operators will also have to look at workstations designed specifically for delivery/pickup, with modular options for heated, chilled and ambient holding. And, rather than hand orders to customers when they arrive, some might use a locker-type model of holding where they’ll text the customer a combination to his or her order. So, they’re running takeout without any customer interaction at all.

- Wibel: What’s interesting about this trend is the mobile-app generation has a lot to do with the growth. But these same folks are also the ones leading the charge for more food ‘experiences.’ So, why is eating restaurant food at home now preferred?

Well, convenience is a big part of that. But I also suspect it has something to do with expectations. Are restaurants giving consumers an experience that makes leaving the house worthwhile?

For many operators, there’s an opportunity to make the restaurant more of a destination that brings business inside the building—either by offering menu items not available for takeout and delivery or just a really unique, fun dining experience.

3. Value Brands Creating an Equipment-Buying Quandary

- Carcione: As the industry sees more lower-price equipment options coming in from offshore manufacturers, many of which are improving in quality compared to what has historically been produced in that part of the world, there are a couple of things to keep in mind.

The quality differences are still there, but they’re not as obvious on their face. So, depending on what operators need or expect, the purchase decision should involve a little more investigation.

Second is the trade war and the pricing fluctuations related to it. Even with the most recent signs of some movement towards a possible agreement, there is still quite a bit of uncertainty around the issue. It could take a while to unfold this next year and, being an election year, anything could happen. So, dealers and volume buyers might ask suppliers about their sourcing capabilities beyond China.

- Wibel: Adding to Joe’s comments about the quality differences and the buying decision, the improvement of imports is such that they now round out a true good–better–best scenario on the dealer’s shelf, which means operators now have options that can align with the appropriate scenario they might be facing.

For operators who are on a razor-thin margin or are facing a more uncertain future—like, say, a startup or an independent that’s trying to compete in a saturated market—a less expensive, ‘good’ import might make sense.

For other operators, especially chains, the value proposition is not a lower initial investment, but buying once and using the same piece of equipment for years to come.

/nemco-logo.png)